Millennials Will be a Tailwind for this Real Estate Sub Sector

Author : Big Byte Insights

It has been a little over three months since the World Health Organization (WHO) declared the coronavirus (COVID-19) a pandemic on March 11th, 2020. At the time, there were 118,000 coronavirus cases in more than 110 countries and territories around the world. Three months later, the number of cases has grown to 9,609,829 worldwide, with 489,312 estimated deaths as of June 25th, 2020.

The virus has not only wreaked havoc across the globe, causing mass human suffering and death, but it has also derailed the world’s economy, propelling it into a recession worse than the Global Financial Crisis of 2009.

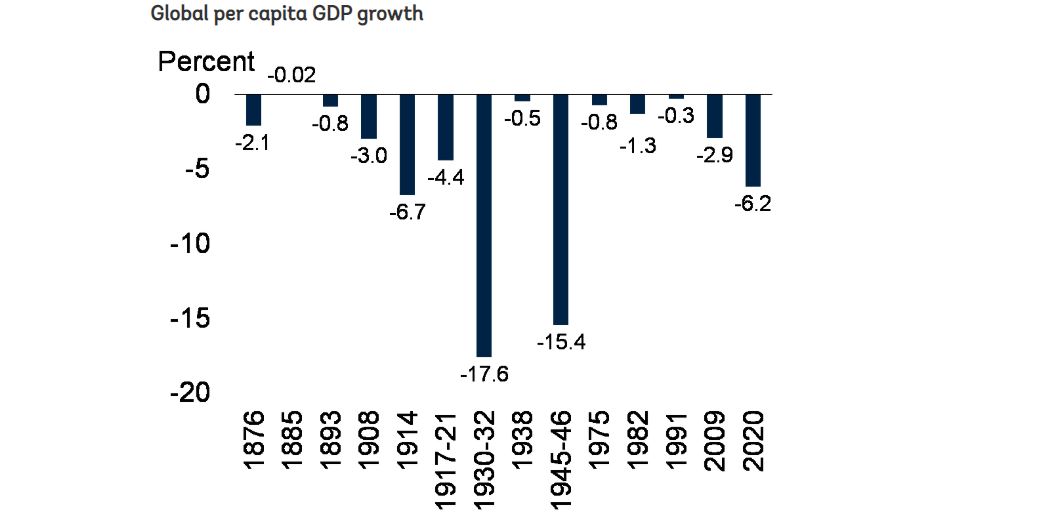

The worldwide lockdown, which ensued after the outbreak, has significantly impacted businesses and employment. The World Bank predicts that the global per capita GDP will contract by 6.2% in the year 2020. According to the World Bank’s estimates, the COVID-19 recession will also include the largest fraction of economies experiencing declines in per capita output since 1870 due to the widespread impact of the virus.

The graph below depicts 14 recessions that the global economy has experienced since 1870. The COVID-19 recession is forecasted to be the deepest since 1945-46 (-15.4%). Moreover, the figure for 2020 is more than twice that of the Global Financial Crises of 2009 (-2.9%).

Dr. Tedros Adhanom Ghebreyesus, the WHO director-general, stated at a media briefing in March:

“This is not just a public health crisis; it is a crisis that will touch every sector. So every sector and every individual must be involved in the fights.”

Unsurprisingly, a virus that has affected employment massively is bound to leave ripple effects in other sectors, including real estate. 22 million people claimed unemployment in the United States during April. Moreover, due to social distancing rules and the global lockdown, the nature of work itself has shifted from an office-based model to a “work from home” model.

This blog endeavors to explore the impact of COVID-19 on the real estate sector. It will look at three different sub-sectors in particular:

- Multifamily Residence

- Single-Family Residence

- Office Space

Impact of COVID-19 on Multi-Family Residence

The highly infectious nature of the coronavirus has forced the world to adopt social distancing practices leading traditional office-based work to shift towards more flexible “remote working” or “work from home” models. For many jobs, the adoption of a remote working model will be a permanent one as people realize that it is indeed possible to do work away from the office.

The increase in home-based jobs means that the allure of multifamily residences situated in metropolitan centers, close to offices, is likely to diminish. During the lockdown, many millennials, who were already in the process of “aging” out of the urban lifestyle, have returned to their childhood homes to take a break from two-room living. These millennials are likely to consider relocation to the suburbs.

According to data sourced from Harris Poll, nearly a third of Americans are considering moving to less densely populated areas in the wake of the pandemic. This may hint towards changes in residential real estate sales and home prices that are yet to come.

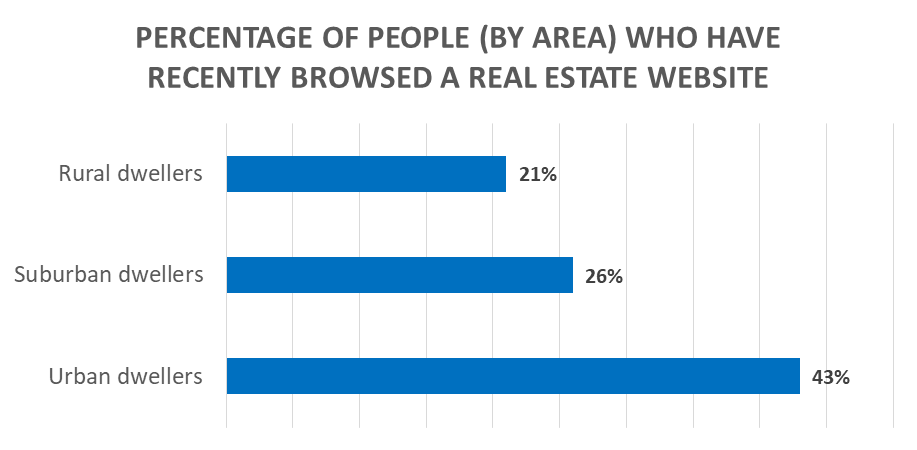

The results of the Harris Poll survey showed that 43% of urbanites browsed a real estate website for homes and apartments to rent or buy, which was almost twice the percentage of suburban (26%) and rural (21%) dwellers.

Source: Harris Poll quoted in USA Today

Lawrence Yun, the chief economist at the National Association of Realtors, predicts:

“People will be much more cautious about living in high-density areas with so many people nearby.”

Yun’s statement brings us to the next point.

Is there hope for Multi-Family Residence in the Light of COVID-19?

Although the multifamily sector is currently facing many challenges, some positive signs support its ongoing resilience.

Zain Jaffer, founder, and CEO of Zain Ventures stated:

“The multifamily real estate sector is resilient, and while long-term effects of this crisis are yet to be known, there are several fundamentals that should provide hope for the future of the multifamily real estate.”

Despite millennials aging out of an urban lifestyle and people considering suburban living, demographic trends continue to favor multifamily demand at the moment. As the future of the economy remains uncertain, people are likely to prefer renting versus owning. This is especially true for graduating students with high debt, as they will prefer to rent due to the challenging nature of securing a mortgage.

While there are many short term concerns regarding multifamily housing, the future may not be as bleak as it seems. The following tailwinds are likely to benefit multifamily investors over the near future:

- Multifamily real estate will remain a substantial investment for pension funds and REITs in a volatile market

- Emergency-level interest rates will benefit long-term investors

- Operating and capital costs of securing new tenants will drastically decrease due to a decrease in tenant turnover

- The decline in the construction of new units will be positive for the sector as the decrease in the supply of new homes is occurring at a time when demand is also low.

In terms of rent uncertainty due to mass unemployment, government benefits are being given to an increasing amount of people that would typically not be recipients. The Coronavirus Aid, Relief and Economic Security Act (CARES Act) passed on March 27th, is a $2 trillion package that surpasses any economic stimulus program in the history of the United States. The Act provides unemployment benefits as well as loans and grants to small businesses to help them maintain payrolls during this crisis. Though the Paycheck Protection Program (PPP) ends on June 30th, the government will continue to inject more money into the economy, through the CARES Act. Other programs in the stimulus would support businesses, which would ultimately enable renters to pay their dues, thereby softening the blow to the multifamily rents.

David Auerbach, a real-estate expert with decades of experience in the REIT space, shared his views on the current situation of the multifamily sector. According to Mr. Auerbach:

“If you have a portfolio with properties all throughout the country, you are probably going to feel the pain less than if you were just focused at one particular city, area, or region. I think if you can spread it out a little bit, you can get a general sense of where the weakness is.”

The Expected Rebound of Single-Family Residence

Though the single-family rental (SFR) market has existed for some time, after the 2009 recession large institutional players began buying single-family property as investments. Back then, operators rented out properties to residents who wanted to live in a home rather than an apartment but could not afford to own them. Fast forward to the present, there are now over 13 million single-family rental units in the United States, with consumers continuing to prefer renting them vs. apartments.

Candace Adams, CEO and President of Berkshire Hathaway Home Services New York, New England and Westchester Properties, stated:

“Millennials want to have more space, but they don’t want the responsibility of owning. Uncertainty makes people more apt to rent, not knowing where the job market might land them. So it’s a fabulous time to move money into real estate as an investment, as opposed to financial markets.”

Single-family rentals not only offer more living space than multifamily residences, but they are also typically located in lower-density areas with lower crime and better schooling options. These features make them attractive to millennials that are looking to settle down and start families, away from the hustle and bustle of large metropolitan areas.

With the increasing popularity of telecommuting, people will start preferring more spacious residences, with outside areas, rather than being cooped up all day in high rise buildings.

David Singelyn, CEO of SFR REIT American Homes 4 Rent, stated during his company’s presentation:

“Once [people are] in the single-family homes, they’re finding they have more space, and this facilitates a better work from home environment.”

Single-family rentals have experienced low-to-mid-single-digit growth in new leases and higher occupancies since the lockdown was first implemented. Urban multifamily REITs, on the other hand, have seen occupancies declining and new lease growth decreasing year-over-year in May.

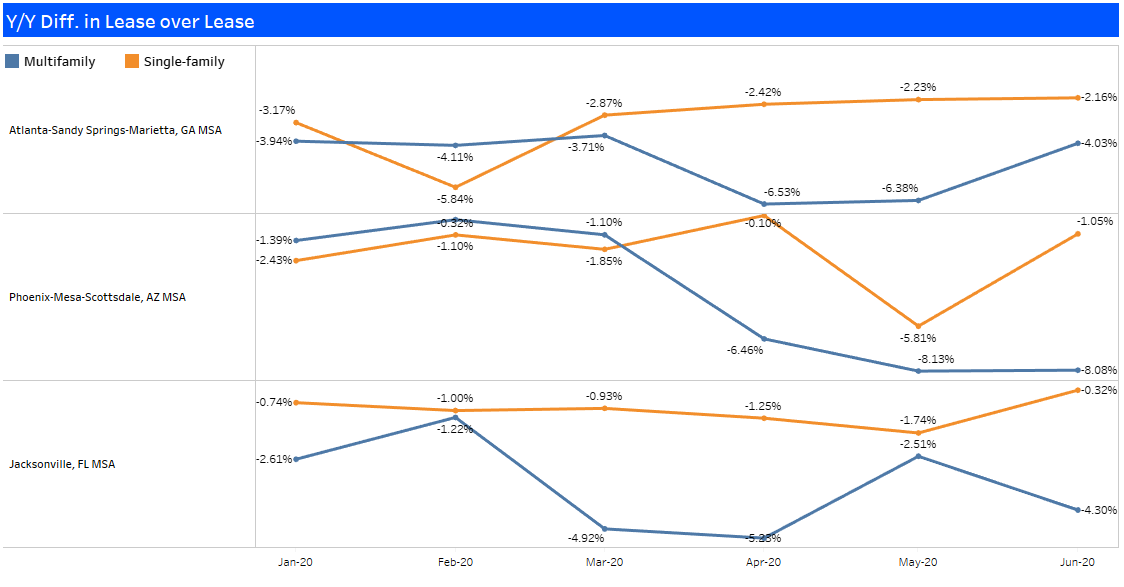

The exhibit below represents the year-over-year difference in the new lease growth of multifamily and single-family properties from January to June 15th, 2020. Since the implementation of stay-at-home ordinances, single-family homes have been outperforming the multifamily apartments in Atlanta, Phoenix, and Jacksonville markets.

Source: Big Byte Insights, Ltd.

Although currently, single-family is outperforming multifamily, in terms of leases, it is essential to keep in mind that there is no guarantee that this continues to be the case. According to Mr. Auerbach:

“Single-family rentals are seeing a huge surge in demand, and I think it’s partly because people are moving out of the cities, …but for right now it’s too early into the picture to tell. Unless we have a crystal ball and can look to the other side, I think the answer is that it’s all unknown.”

Telecommuting and the Future of Office Space

The coronavirus lockdown has changed the way a lot of people work. Working from home or telecommuting is the new normal.

Many workers, who previously commuted to the office, have been forced to use online tools and adapt to virtual meetings with clients and colleagues. The shift to working from the home model has left many wondering whether the future of office space is now obsolete.

Karen Harris of Bain’s Macro Trends in New York believes:

“Once effective work-from-home policies are established, they are likely to stick.”

Concerns about exposure to the virus are likely to persist until a vaccine or a credible treatment is made widely available. This means that the demand for office space is expected to decline until the pandemic is over and perhaps will not recover to the pre-pandemic level even in the long run.

Sectors like tourism and leisure are the worst affected and need less office space currently. In contrast, e-commerce and technology sectors are booming as well as more likely to adopt a virtual working model. Twitter, for example, is giving its employees the option of working from home permanently if they want to.

With the onset of the recession, many companies have downsized, with some companies going through multiple rounds of layoffs. Organizations will try their best to reduce fixed costs, and the typical tenant might start wondering whether they need office space for all their employees, or would it be better to reserve it for a few.

Magnus Meyer, Managing Director WSP Nordics & Continental Europe claimed:

“This crisis is probably going to accelerate the need for modern, flexible office space with lots of services.”

To attract workers, offices will need to have safe working environments. The “hotelization” of office space is likely to accelerate, to remain an attractive alternative to working from home. Thus, offices with a cozier, more spacious ambiance are likely to be preferred by employees.

Conclusion

Though one can observe certain sectors (like single-family rentals) benefitting currently, under the impact of the coronavirus, and others (such as multifamily rentals) at a disadvantage, it is essential to note that the future is filled with numerous possibilities – none of them absolute. The long-term impacts of the pandemic can only be known once the virus abates, and life returns to normal, or at least the new definition of normal.

Appendix:

The videos below display the clusters of multifamily and single-family properties across three different MSAs. As one would expect, multifamily homes are clustered together in the urban, more populated areas of all three markets, while single-family residences are spread out throughout the region.

Please note, the y/y differential in new lease growth of multifamily apartments in May of 2020 is decidedly less than that of single-family residences in each of the three areas.

Atlanta (June-20 data is month-to-date till 6/15/20):

Phoenix (June-20 data is month-to-date till 6/15/20):

Jacksonville (June-20 data is month-to-date till 6/15/20):