Applying Machine Learning to REIT Stocks

Author : Adam Cristelli, CFA

Summary

Machine learning is just one aspect of data science that can be applied to improve stock selection by analyzing alternative data as well as historic valuation data in the REIT space. While the right model can be highly accurate, the model should not be used as a driver of investment decisions, but rather a screening tool to help analysts find potential overweight and underweight opportunities in each REIT sector.

Methodology

The following analysis looks at various alternative data in conjunction with historic NAV and FFO premium valuation data to determine if the combined features/variables can create a machine learning model to properly categorize stocks as overweight, neutral or underweight based on forward one quarter returns. The data analyzed is from the self storage, multi-family, and single family REIT sectors. The steps taken are as follows.

Data Transformation

Alternative data is transformed to be relative to sector median at each date. Valuation data is transformed to be relative to each stock’s historic relative valuation compared to the sector. Looking at valuation data in this manner adjusts for stocks that permanently trade at premium or discount to the sector. Valuation data is a critical component of data analysis in public equities as what’s “priced in” the stock is a huge factor in determining its future performance.

Model Selection

A series of classification models were chosen for each sector and trained using a walk-forward methodology. The training period starts at the beginning of 2016, and is tested starting at the beginning of 2019. Each model is trained on data up to the test date, tested on the data from that one date, then a new model is trained using all data up to the next date, tested, and so on. This method prevents data leakage, limiting testing to out of sample data. All in all, over 4,400 models were created for each sector.

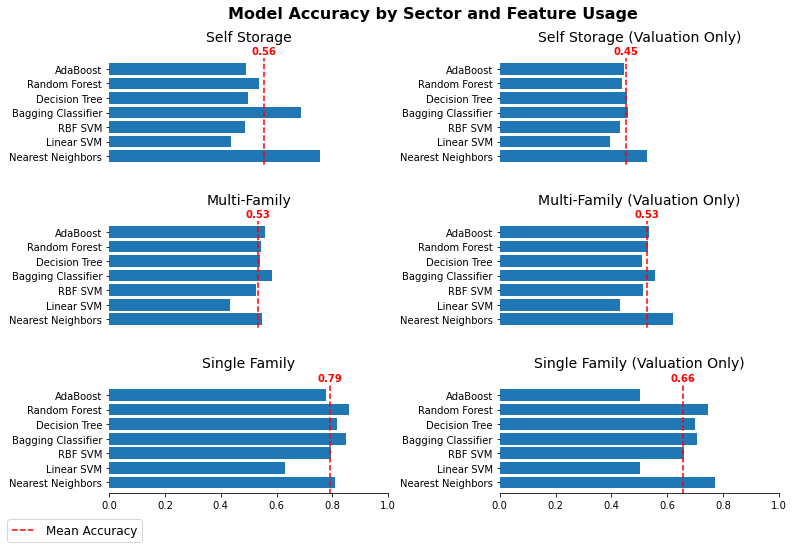

Models were trained using alternative data and valuation data, or just valuation data for each sector. The model classifies each stock as overweight, underweight, or neutral, based on relative forward returns for each month. The following chart examines the accuracy of each model in predicting whether to go overweight, underweight, or remain neutral based on relative performance over the subsequent three month time period:

Model accuracy is improved significantly in the self storage and single family REIT sectors when alternative data is included in the features analyzed. Next we will look at how the most accurate models’ recommended overweights in each sector performed vs the equal weighted sector benchmark.

Each model did a decent job of predicting three month outperformers since the beginning of 2019. The self storage model using both alternative and valuation data appears to be the most consistent. If implemented in real time, the models’ hyper parameters could be tuned to improve accuracy even further as time goes on. Also, more features can be added to see if accuracy improves. This type of analysis is constantly evolving.

Risks

While these results are impressive, there are a few risks that must be pointed out:

- Data prior to a change in market regime can become obsolete, which limits training time periods. This means the models could be impacted by momentum. Ideally, a model should be able to be trained on several years worth of data and work in any time period, but finding a data set like that is extremely rare.

- The black-box nature of the models and complicated math behind how the algorithm recognizes patterns means that a significant amount of trust is required to implement these models in real time. That is why I recommend these models be used as a screening tool to help fundamental analysts and not as the driving force behind investment decisions.

Machine Learning is just one way in which data science can aid in fundamental REIT analysis. The idea that data science and analytics can only be implemented in pure quant strategies is antiquated. Data science allows for analysts to understand more about more companies, visualize data to improve communication with PMs and clients, and automate modeling to allow the analyst to focus on catalyst generation.

Author Bio:

Adam Cristelli, CFA is a real estate consultant focused on applying data science to the fundamental investment process. Adam has over 13 years of commercial real estate/REIT investment experience. He started his career at Heitman Real Estate Securities and spent 11 years with the firm, first as an equity analyst, then as an assistant portfolio manager responsible for analyzing REITs in various property types across North America.

Adam has a BA in Business Administration with a concentration in Finance/Real Estate from Colorado State University. He is a member of the CFA Institute, as well as the CFA Society of Denver. Adam is also an entrepreneur and is the co-founder of a mixed martial arts studio in Boston, MA.

For more details on the analysis, Adam can be contacted via linkedin: https://www.linkedin.com/in/adam-cristelli-cfa-49279220/